|

| credit card chase freedom unlimited |

credit card chase freedom unlimited is a visa card with which you can easily make purchases from anywhere with peace of mind and get attractive offers and cashback. You will get a minimum cashback offer of up to $500 from this Khan and many more earning opportunities are provided like 5% cashback on using this card during travel and 3% cashback on purchases of medicine and other purchases. 1.5% cashback for that, and up to 3% cashback on restaurant dining is given as a welcome bonus to new card holders.

The best part about credit card chase freedom unlimited is that it has no annual fee because the annual fee is 0$ which is amazing.

You can get up to $2000-$300 cashback in the first year after applying online if you always make essential purchases with this card.

It has some fees like 3% USD deduction for foreign transaction fee, 3% deduction during balance transfer not 3% for first 2 months but 5% deduction from next month which is more than other cards but its good side is more. being done

Its penalty APR is 29.99% and annual fees are $0.

Today it has become very challenging for us which card will be right for us because now there is a lot of competition that’s why the price of everything is high and sometimes low so we have to check well before choosing the right credit card. So chase freedom card can be said to an example that you can use. The attractive reward of credit card chase freedom makes it even more attractive because if you have one card you will get double the bonus you get when you have another card.

Although cashback credits offer 1% cash back chase freedom unlimited offers 1.5% cashback which will help you save a lot of money on your shopping it has 0% apr so if you don’t want to lose this offer then this is it. can take

student credit card chase freedom

If you are a student then the student credit card chase freedom is a great gift for you as you can save a lot of money with this card and it is great for saving your money. Its specialty is that it is a secured card, you are getting security here with maximum facilities and security. Although other credit cards deduct the annual fee, chase freedom unlimited does not charge any kind of annual fee, as the reason can be said that its annual fee is 0%.

This is a great opportunity for students who want to build credit while saving money.

chase freedom credit card login

You have to sign up before login chase freedom credit card After signing up you can log in and get a cash back offer along with signing up with no annual fee for the first 15 months. With the help of this, you will get cashback offers on everything including travel, tickets, dinner, clothes, children’s food, and children’s medicine.

To sign up, you have to follow the following steps: First, you have to enter the chase freedom unlimited site, then you will see the signup and login options at the top right. If you have already signed up, you can click on login and enter your email and username. You can log in with

chase freedom unlimited credit limit

Everything has a limit and this card also has a minimum limit of 500 USD for each authorized person of chase freedom unlimited credit, but a customer can get attractive offers with cashback up to 5000 USD.

However, most users have a limit of $1000 to $5000 and the average limit is $3000. They have a regular APR of 17.24% to 25.99%.

What are the disadvantages of credit card chase freedom unlimited?

General has some disadvantages like when you do foreign transactions 3% will be deducted from you for every transaction this charge is much higher than other cards whereas all other cards have a maximum charge limit of 2%. So it is expected that when you transact internationally, you will be charged extra and if you don’t want to face this problem, you can choose any other card.

Chase Freedom Unlimited’s regular APR ranges from 17.24% to 25.99%, with an average of 18.89%.

read more: what is insurance travel international and how its work for us

But despite all these downsides, the Chase Freedom Unlimited card is the best card in the market right now and has a lot of competition.

7 ways to maximize your chase freedom unlimited

Things you can do to increase your rewards on the Chase Freedom Unlimited Credit Card include: using the card regularly, taking it with you on any purchases and whether it’s something you like, using it when traveling, traveling For this, you get 5% cashback on ticket purchases, when you go out to eat at a restaurant and pay your bills with this card, you will get 3% cashback which will help you save money if you pay any of your bills with this card up to $20,000 in the first year. Then you get an extra 1.5% back on it which is unbelievably true.

When you travel, you will be given 5% cash back if you pay your hotel bill, car bill, food bill with the card.

If you want to get 3% cash back at restaurants, order delivery with Chase Freedom Unlimited credit card and use this card every time you eat or buy something, including takeout.

When you get sick or need to buy medicine, you can get up to a 3% bonus on medicine purchases with the Chase Freedom Unpaid Credit Card.

From the above discussion, the cashback offer of the Chase Freedom Unlimited Credit Card may seem low, but when these small cash backs add up at the end of the year, you can easily buy something else with this cash-back offer. Again you will get cashback which can be said to be incomparable.

Benefits of credit card chase freedom unlimited

If you book a travel ticket or hotel reservation with your cord, if you fall ill and want to cancel your ticket or booking, you will definitely get this opportunity from chase freedom unlimited. Buy anything from the credit card chase freedom unlimited card anytime without any hassle but when you cancel the booking or ticket some charges will be deducted.

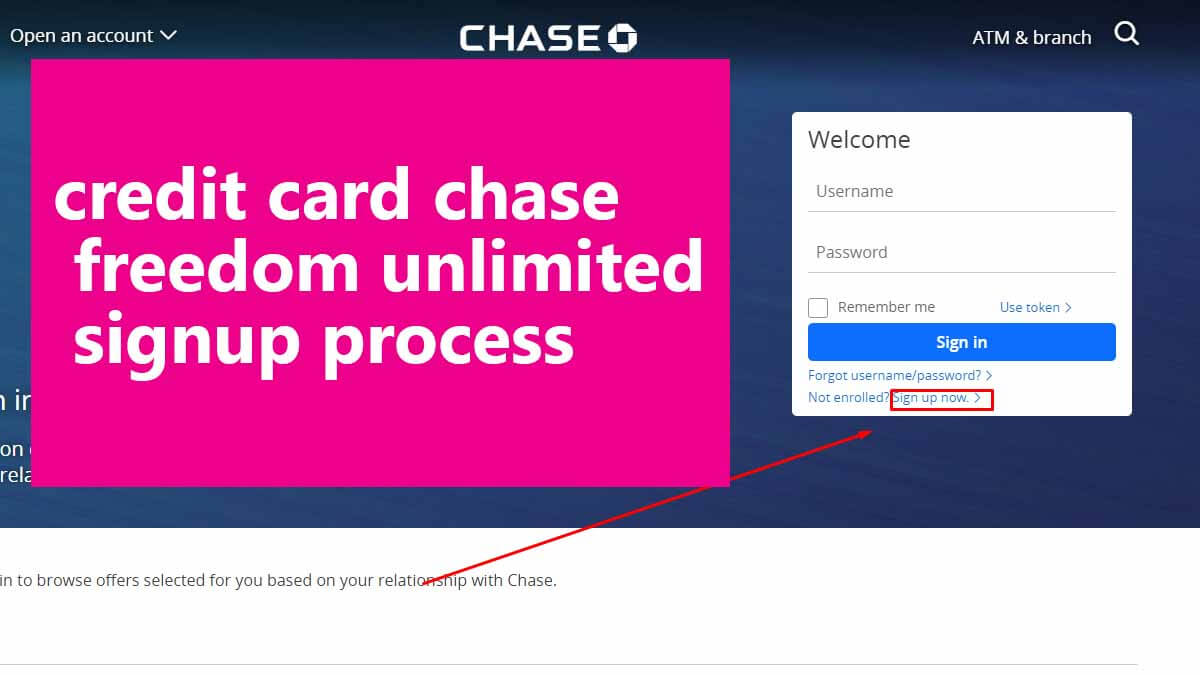

credit card chase freedom unlimited signup process

To sign up, you have to visit their website, you can see the signup button on the home page, and click on it.

After that, you will be shown a dashboard where you have to give their requirements like for whom you will open this account for yourself, for business, or commercial if you want to open it for yourself then on a personal day.

read more: our recent article best weight loss exercises for home and it’s important everybody who wants to be healthy

|

| credit card chase freedom unlimited signup |

Then you have to give an account number or, credit card number or application number

Then you have to give your social security number this is very important so write everything down in a notebook so that if you forget your account can be restored again so I suggest you write it down.

If you don’t have a social security number, you can give your date of birth because it’s better for you.

After that, you have to give your username. Hope everyone knows the username. A username is a name with which you can log in or the name your account will show is the username so remember this too.